What Happens Now?

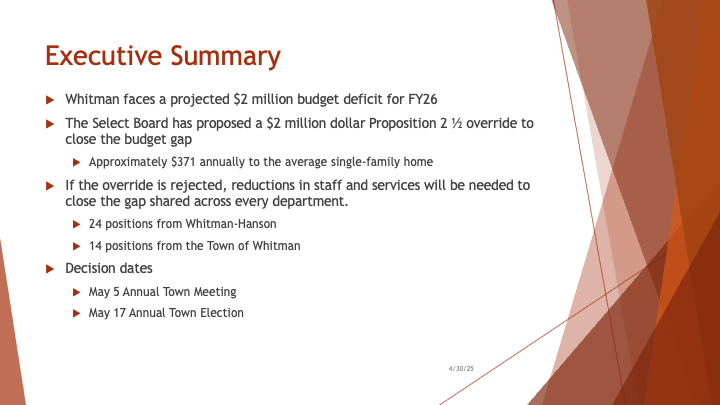

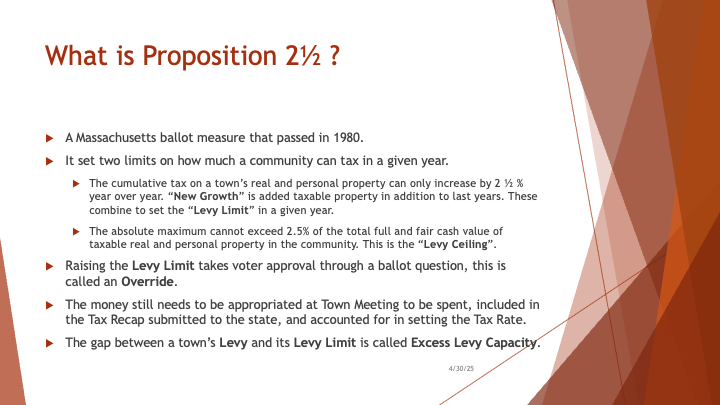

May 17 Annual Town Election: This allows the town to raise taxes above the limits of Prop 2 ½.

If it passes, we have a balanced budget

If it fails, we need a Special Town Meeting to balance the budget.

WHRSD budget rejected. School Committee to reassess the town within 30 days. Town meeting to vote it 45 days from the reassessment.

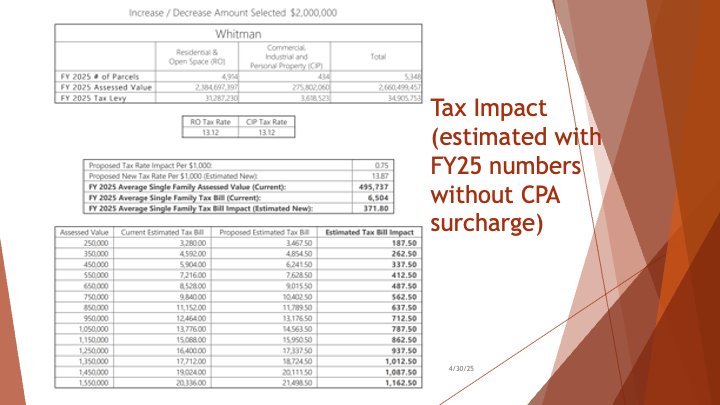

This tool is an estimate based on current fiscal year (FY25) tax rates and valuations. Any override would be applied to FY26. Override amount currently based on deficit discussed at the Mar. 25 Select Board meeting.

Whitman Tax Calculator - FY25 with Override & CPA

$

Calculations based on:

- Proposed Override: $2,000,000

- FY24 Tax Rate: $12.74 per $1,000

- FY25 Proposed Tax Rate: $13.12 per $1,000

- CPA Surtax: 1% (with $100,000 residential exemption)

- FY25 Total Assessed Value: $2,660,499,457